|

<Research Group on Syndicated Loans>

1. The Legal Theory of Syndicated

Loans in the Primary Market

2. Collective Settlement and Applicable Law of

Credit in International Finance Contracts

1. Objective

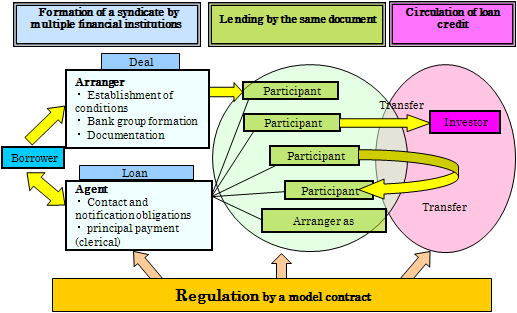

The objective of this research is to bridge global syndicated loans and local legal rules,

and propose a model contract in order to appropriately regulate totality of obligations from the primary market to the secondary market.

In many sectors of Japanese law, it is unclear how global transactions are dealt with.

Even in domestically aimed model syndicated loan contracts, which widely incorporate international loan contracts, gaps of uncertainty are left that should be covered by law.

Contracts and law alone cannot completely deal with these global transactions. Explanatory notes to model contracts also do not fill these gaps.

This research will attempt to fill in the above-mentioned gaps between global transactions and contracts and law.

2. Expected results

This research is expected to produce the following results.

ç@The rational role and responsibility of law and contract will be clarified so the appropriateness of supervisory regulations and mandatory rules such as the Corporate Bond Act can be verified.

çA In contrast to the currently recommended standard contract, by presenting

an alternative plan that considers the interests other than those of financial

institutions, it becomes possible to reduce the information gap and bargaining

power of financial institutions.

çBWhile becoming a reference to the interpretation of other contracts, a

model contract makes the drafting of individual contracts easier.

çCThrough the creation of a model contract, it is greatly expected that

the distance between global transactions and local law can be reduced.

|

|

ü@member's page ü@member's page

üiJapanese Only)

ü@NOMURA YOSHIAKI'S page ü@NOMURA YOSHIAKI'S page

|